Finance Minister Nirmala Sitharaman, in her ninth consecutive budget presentation, laid out a fiscal roadmap that, at first glance, might seem to lack the usual “big bang” announcements. However, as we peel back the layers, a strategic narrative emerges—one that prioritizes resilience, execution, and a steady march towards long-term goals rather than short-term populism. This budget, in essence, is a masterclass in strategic patience and consistent execution, aiming to build a robust economic foundation for the decades to come .

Let’s delve into a detailed analysis of Union Budget 2026

The Macro View: Fiscal Prudence Meets Growth Ambition

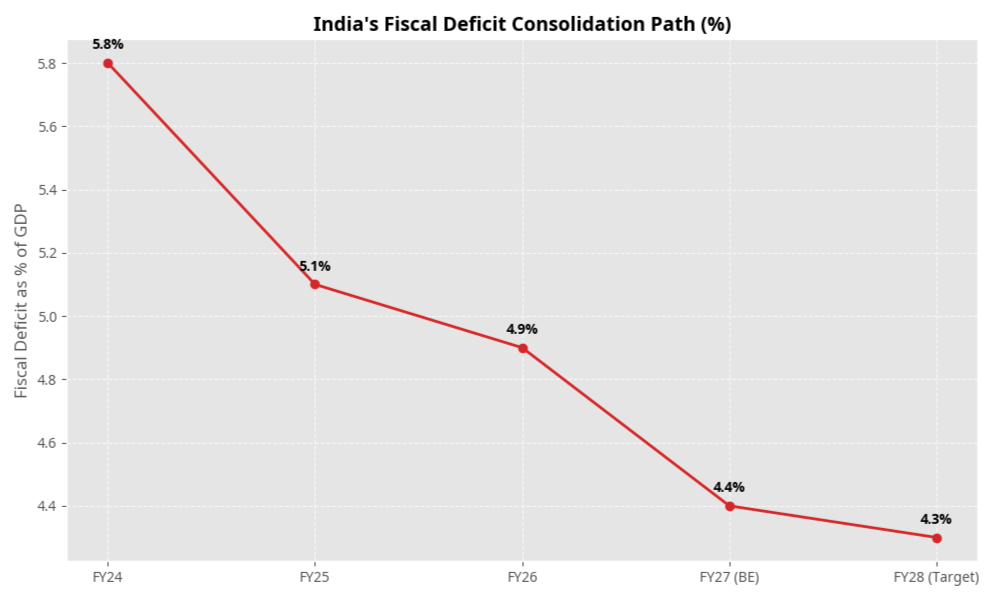

One of the most reassuring aspects of Budget 2026 is its unwavering commitment to fiscal consolidation. In an era where global economies are still navigating inflationary pressures, geopolitical uncertainties, and supply chain disruptions, India has set a clear and credible path for its fiscal deficit. The target of 4.4% for FY27, with an outlook of 4.3% for FY28, signals a responsible approach to public finances. This isn’t just an arbitrary number; it’s a crucial indicator that reassures both domestic and international investors about India’s economic stability and its commitment to long-term macroeconomic health. A controlled fiscal deficit helps manage inflation, keeps interest rates in check, and frees up capital for private sector investment, thereby fostering sustainable growth and ensuring that the government lives within its means .

This fiscal glide path is particularly commendable given the global economic headwinds. Many developed nations are still grappling with elevated debt levels and inflationary pressures, making India’s commitment to fiscal discipline a standout feature. It demonstrates a clear understanding that sustainable growth cannot be built on an unstable financial foundation. The government’s strategy is to gradually reduce the fiscal deficit without stifling growth, a delicate balancing act that requires careful planning and execution.

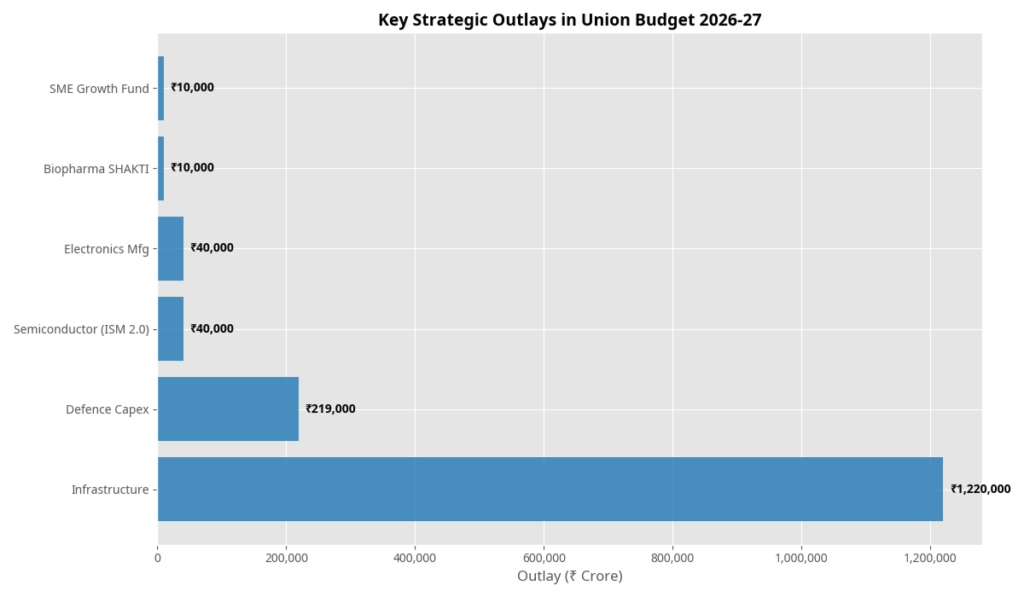

But fiscal prudence doesn’t mean sacrificing growth. Far from it. The government’s continued emphasis on capital expenditure (capex) is a testament to its growth ambition. A staggering ₹12.2 lakh crore has been earmarked for public capital expenditure in FY27. This represents a significant year-on-year increase and underscores the government’s belief in the multiplier effect of public investment. This sustained push is designed to crowd in private investment, creating a virtuous cycle of infrastructure development, job creation, and economic activity. Think of it as laying a robust foundation for a skyscraper—it might not be the most glamorous part, but it’s absolutely essential for the structure’s long-term stability and height. This strategic allocation of capital is expected to boost demand, enhance productive capacity, and improve the overall competitiveness of the Indian economy.

Let’s visualize this commitment to fiscal discipline and the projected trajectory:

This chart clearly illustrates the government’s consistent effort to bring down the fiscal deficit, moving towards a healthier economic environment. It’s a strategic choice that underscores continuity and a long-term vision, providing a stable macroeconomic backdrop for the ambitious goals of Viksit Bharat.

Sectoral Deep-Dive: The “Trump-Proofing” Strategy and Beyond

If there’s one overarching theme that resonates through the sectoral allocations, it’s a strategic push towards “Trump-proofing” India’s economy—a term I use to describe the proactive measures taken to bolster domestic capabilities and reduce reliance on volatile global supply chains. In a world increasingly marked by protectionism, geopolitical tensions, and the weaponization of trade, this budget makes a decisive move towards self-reliance, or Atmanirbharta. This isn’t about isolation; it’s about building resilience and strategic autonomy in critical sectors, ensuring that India can navigate global disruptions with greater confidence.

Manufacturing 2.0: From Chips to Containers, Building Global Competitiveness

The budget places a significant bet on scaling up manufacturing in strategic and frontier sectors, recognizing that a strong manufacturing base is crucial for job creation, export growth, and overall economic development. The India Semiconductor Mission (ISM) 2.0 receives an enhanced outlay of ₹40,000 crore, signaling India’s serious intent to become a global player in chip manufacturing. This isn’t just about assembling; it’s about fostering design, research, and fabrication capabilities, moving up the value chain in a highly complex and strategically vital industry. The goal is to attract global semiconductor giants and nurture domestic champions, creating a vibrant ecosystem for advanced electronics .

Similarly, the Electronics Components Manufacturing Scheme also sees its outlay increased to ₹40,000 crore, aiming to deepen domestic value addition and capitalize on the rising investment momentum. These initiatives are not just about producing goods; they are about building an entire ecosystem, fostering innovation, and creating high-skilled jobs that will drive India’s technological future. The focus is on reducing import dependence and making India a reliable hub for electronics manufacturing, catering to both domestic and international markets.

Perhaps one of the most intriguing and forward-thinking announcements is the establishment of Rare Earth Corridors in states like Odisha, Kerala, Andhra Pradesh, and Tamil Nadu. Rare earth elements are critical for advanced technologies, from electric vehicles and wind turbines to smartphones and defense systems. By promoting mining, processing, research, and manufacturing of these materials domestically, India is securing its access to vital resources and reducing its vulnerability to global supply shocks. This is a clear move to control strategic inputs, much like how nations control oil reserves, and positions India to be a key player in the global green economy transition.

The Biopharma SHAKTI scheme, with an outlay of ₹10,000 crore over five years, aims to transform India into a global biopharma manufacturing hub. This goes beyond India’s traditional strength in generic drugs, pushing towards the more complex and high-value segments of biologics and biosimilars. The plan includes establishing three new National Institutes of Pharmaceutical Education and Research (NIPERs) and upgrading seven existing ones, alongside creating a network of 1,000 accredited clinical trial sites. This is a comprehensive strategy to build capacity, foster innovation, and strengthen India’s position in the global pharmaceutical landscape, making it a reliable source for advanced medicines and research .

Even seemingly mundane sectors like Container Manufacturing receive a dedicated scheme with a budgetary allocation of ₹10,000 crore over five years. This addresses a critical logistics bottleneck, especially in international trade, and aims to build globally competitive capacity. The lack of sufficient domestic container manufacturing has often led to higher logistics costs and delays, impacting India’s export competitiveness. This initiative will not only support domestic industry but also enhance India’s trade infrastructure. Furthermore, the rejuvenation of 200 legacy industrial clusters through infrastructure and technology upgradation demonstrates a commitment to improving the cost-competitiveness and efficiency of existing industries, ensuring that traditional sectors are not left behind in the pursuit of modernization.

Here’s a snapshot of some key strategic outlays, illustrating the government’s investment priorities:

This visualization highlights the significant financial commitment towards building a self-reliant and technologically advanced manufacturing base, which is a cornerstone of the Viksit Bharat vision. The investments are strategically chosen to create ripple effects across the economy, generating employment and fostering innovation.

The Digital Frontier: Data is the New Soil, Cultivating a Digital Economy

In the 21st century, data is often referred to as the new oil, but perhaps a more apt analogy is that data is the new soil—the fertile ground upon which digital economies grow. Budget 2026 recognizes this fundamental truth, placing digital infrastructure at the heart of India’s investment-led growth strategy. This strategic focus is not merely about technological advancement; it’s about creating a foundational layer for future economic prosperity, enabling innovation across various sectors, and enhancing India’s global competitiveness in the digital age.

One of the most forward-looking and impactful announcements is the tax holiday till 2047 for data center operations commencing on or before March 31, 2031. This, coupled with a long-term tax holiday for foreign companies providing cloud services using data center infrastructure in India, is a powerful incentive designed to attract hyperscalers, cloud service providers, and digital infrastructure investors. This policy provides the much-needed predictability and investment certainty that large-scale digital infrastructure projects require, aligning perfectly with the burgeoning demand from digital services, fintech, e-commerce, artificial intelligence (AI), and global capability centers . The implications are profound: a robust data center ecosystem will not only support India’s own digital transformation but also position the country as a critical hub for global data processing and storage, potentially attracting significant foreign direct investment and creating numerous high-value jobs.

The budget also extends its vision to nurture the Animation, Visual Effects, Gaming, and Comics (AVGC) sector, recognizing the immense potential of the creative economy, often referred to as the Orange Economy, for skilled employment and export. This focus on the AVGC sector, projected to require a staggering 2 million professionals by 2030, is a clear signal of preparing the “Yuva Shakti” (youth power) for the jobs of the future. By investing in this sector, the government aims to tap into India’s vast talent pool, fostering creativity and innovation that can translate into significant economic value and cultural soft power on the global stage. Furthermore, the rationalization of taxation for IT services, including software development, IT-enabled services (ITeS), Knowledge Process Outsourcing (KPO), and contract R&D, under a unified category of Information Technology Services with a common safe harbor framework, aims to further solidify India’s position as a global IT hub. These measures are designed to reduce compliance complexities, enhance tax certainty, and encourage further investment and growth in India’s already thriving technology sector.

Infrastructure & Urbanization: Beyond the Metros, Building a Connected and Equitable India

The budget’s infrastructure push extends far beyond traditional highways and railways, demonstrating a keen eye on regional development, urban transformation, and multimodal connectivity. The development of seven High-Speed Rail corridors is a monumental undertaking that will not only drastically reduce travel times and strengthen inter-city connectivity but also foster economic agglomeration across major growth regions. These corridors are envisioned as catalysts for economic development, attracting investment, and creating new industrial and commercial hubs along their routes. This is about more than just faster travel; it’s about creating new economic arteries for the nation, facilitating the faster movement of goods and people, and integrating diverse regions into a more cohesive national economy.

Perhaps even more impactful for inclusive growth is the continued and intensified focus on infrastructure development in Tier II and Tier III cities, which are increasingly emerging as new growth centers. The budget recognizes that sustainable national development requires decentralization of economic activity beyond the saturated metropolitan areas. The innovative concept of City Economic Regions (CERs), backed by an allocation of ₹5,000 crore per region over five years, aims to unlock agglomeration-led growth and strengthen urban economic clusters through a challenge-based, reform-linked financing model. This approach encourages states and local bodies to compete for funds by presenting robust development plans, fostering a spirit of cooperative federalism and ensuring that investments are strategically deployed to maximize impact. This decentralization of growth is crucial for balanced national development, reducing regional disparities, and creating opportunities closer to where people live .

The expansion of inland water transport through the operationalization of 20 new National Waterways represents a quiet but profound revolution in logistics. India, with its extensive river network, has historically underutilized this cost-effective and environmentally friendly mode of transport. This initiative will significantly improve efficiency, reduce transportation costs for bulk goods, and enhance connectivity between industrial clusters, mineral-rich regions, and major ports. By diversifying transportation modes, the budget aims to decongest roads and railways, lower the carbon footprint of logistics, and thereby boost trade and economic activity, making Indian goods more competitive in global markets. This holistic approach to infrastructure development, encompassing high-speed rail, urban development, and waterways, is designed to create a seamless and efficient logistics network that is vital for a rapidly growing economy.

The Social Contract: Yuva Shakti and MSMEs – Empowering Human Capital and Grassroots Growth

The budget reaffirms the government’s profound commitment to its social contract, particularly focusing on the “Yuva Shakti” (youth power) and Micro, Small, and Medium Enterprises (MSMEs). These two pillars are not just segments of the economy; they are the very backbone of India’s demographic dividend and entrepreneurial spirit, crucial for achieving inclusive and sustainable growth.

MSMEs are widely recognized as critical drivers of employment generation, export growth, and supply-chain resilience. The budget introduces a suite of targeted measures designed to support their scale-up, formalization, and integration into the broader economic fabric. A significant highlight is the creation of a dedicated ₹10,000 crore SME Growth Fund, specifically designed to foster “Champion SMEs.” This fund aims to provide much-needed capital and strategic support to promising small and medium enterprises that demonstrate high growth potential, enabling them to innovate, expand, and compete effectively in both domestic and international markets. Furthermore, the Self-Reliant India Fund receives a substantial ₹2,000 crore top-up, specifically allocated to support micro-enterprises and ensure their continued access to risk capital . These measures are not merely financial injections; they are strategic investments in nurturing entrepreneurship, fostering innovation at the grassroots level, and creating a robust ecosystem where small businesses can thrive, thereby contributing significantly to job creation and economic diversification.

For the youth, the budget outlines a forward-looking strategy to harness India’s demographic dividend. The establishment of a High-Powered ‘Education to Employment and Enterprise’ Standing Committee signals a strategic and coordinated approach to bridge the skill gap and align educational outcomes with the dynamic requirements of the industry. This committee will play a pivotal role in designing curricula, promoting vocational training, and fostering industry-academia collaboration to ensure that India’s vast youth population is equipped with the skills necessary for the jobs of the future. This is a crucial step towards converting India’s demographic dividend from a potential into a productive and competitive workforce, capable of driving innovation and economic growth.

In the critical sector of healthcare, the budget emphasizes strengthening services and strategically positioning India as a global destination for medical value tourism. The establishment of five Regional Medical Value Tourism Hubs, developed in partnership with the private sector, is a visionary move. These hubs are envisaged as integrated healthcare complexes offering advanced medical and surgical services, medical education and research, and comprehensive post-treatment care. Concurrently, the expansion of institutions for Allied Health Professionals (AHPs) aims to address critical skill gaps across various medical disciplines, from diagnostics to clinical support and behavioral health services. This dual focus on enhancing domestic healthcare infrastructure and services, while simultaneously attracting international patients, underscores India’s potential to become a global healthcare provider, leveraging its skilled medical workforce and cost-effective treatments . This also creates significant employment opportunities within the healthcare sector and allied industries, contributing to both economic growth and improved public health outcomes.

The “Fly in the Ointment”: Taxation and Market Reactions – Balancing Revenue, Regulation, and Relief

No budget is without its contentious points, and Budget 2026 saw the increase in Securities Transaction Tax (STT) on futures and options as the primary “fly in the ointment” for market participants. The STT on futures was increased to 0.05% from 0.02%, and on premium options to 0.15% from 0.1%. This announcement, while seemingly minor in the grand scheme of the budget, led to a sharp, albeit temporary, reaction in the stock market, with the Nifty dropping nearly 3% at one point . This immediate market response highlights the sensitivity of financial markets to even subtle changes in taxation, particularly in high-volume trading segments like derivatives.

While many investors and market analysts were hoping for some relief on long-term capital gains tax to attract foreign investment and boost market sentiment, the government’s move signals a different, perhaps more fundamental, priority. The increase in STT can be interpreted as a measure aimed at curbing excessive speculative activity in the derivatives market, promoting more long-term, fundamental-driven investing, and potentially generating additional revenue to fund its ambitious developmental agenda. As one expert astutely noted, for the Finance Minister, the financial markets are just one constituency among a billion aspirations. The broader focus remains on ensuring that the “Yuva Shakti” and the wider population benefit from economic growth, even if it means a temporary jolt to market sentiment. This reflects a policy stance that prioritizes real economic activity and inclusive development over purely financial market exuberance.

On a more positive note for the common taxpayer, the budget introduces a simplified and modernized Income Tax framework, featuring redesigned rules and forms aimed at significantly reducing compliance complexity and improving the ease of filing. This is a welcome and long-overdue step towards making the tax regime more user-friendly and transparent, particularly for individuals and small businesses. Such reforms can foster greater tax compliance, reduce administrative burdens, and improve the overall taxpayer experience . The emphasis on trust-based tax administration, including rationalization of penalties and decriminalization of minor offenses, further reinforces the government’s commitment to creating a less adversarial and more facilitative tax environment.

Furthermore, the budget includes significant rationalization of customs and indirect tax provisions. This involves the phased removal of long-standing customs duty exemptions on domestically manufactured items, a move that directly reinforces the push for local industry and self-reliance. By leveling the playing field for domestic producers, the government aims to encourage local manufacturing, create jobs, and reduce import dependence. The incorporation of effective rates directly into the tariff schedule also enhances transparency and certainty for businesses, while expanded duty-free and concessional duty provisions for export-oriented sectors aim to boost India’s competitiveness in global trade. These customs reforms are strategically aligned with the broader “Make in India” and “Atmanirbhar Bharat” initiatives, aiming to create a more robust and self-sufficient industrial base.

Climate Technologies and Energy Transition: Powering a Sustainable Future

Recognizing the global imperative of climate action and the economic opportunities in green technologies, Budget 2026 significantly strengthens India’s commitment to climate resilience and industrial decarbonization. This is not just an environmental agenda; it’s a strategic economic one, aiming to position India as a leader in the emerging green economy.

A key measure in this regard is the proposed outlay of ₹20,000 crore over the next five years for Carbon Capture Utilization and Storage (CCUS) technologies. This substantial investment signals a serious intent to scale CCUS technologies and achieve higher readiness levels across five critical industrial sectors: power, steel, cement, refineries, and chemicals. These sectors are typically energy-intensive and significant emitters, making CCUS a vital tool for their decarbonization. By investing in CCUS, India aims to reduce its carbon footprint while ensuring continued industrial growth, thereby balancing environmental responsibility with economic development. This initiative will also foster research and development in cutting-edge green technologies, creating new industries and job opportunities.

These initiatives are designed to support India’s long-term energy security while enabling cleaner industrial growth. The budget’s focus on climate technologies extends to promoting renewable energy, electric mobility, and green hydrogen, though specific new allocations might be embedded within broader infrastructure or manufacturing schemes. The overarching goal is to transition towards a low-carbon economy, reduce reliance on fossil fuels, and harness the potential of green industries for sustainable development.

Tourism: Unlocking India’s Experiential Potential

Tourism, often hailed as a significant job creator and foreign exchange earner, receives a comprehensive boost in Budget 2026. The budget adopts an integrated approach to strengthen tourism infrastructure, enhance skills development, and leverage digital platforms to improve visitor experiences and destination management. This is about transforming India into a premier global tourism destination, moving beyond traditional offerings to embrace experiential and niche tourism.

Key initiatives include the development of 15 archaeological sites into vibrant, experiential cultural destinations. This involves curated access, immersive interpretation, and modern amenities to attract both domestic and international tourists. The focus is on creating a holistic experience that combines history, culture, and entertainment, thereby increasing visitor engagement and local economic benefits. Furthermore, the promotion of ecologically sustainable tourism, including mountain trails, turtle trails, and bird-watching trails across select regions, highlights a commitment to responsible tourism that preserves natural heritage while generating livelihoods.

Targeted initiatives are also in place to strengthen tourism circuits in emerging destinations, including heritage, spiritual, and nature-based tourism hubs. This regional approach ensures that the benefits of tourism are distributed more widely, fostering local entrepreneurship and community development. The alignment of tourism development with regional infrastructure and connectivity initiatives, such as improved roads, railways, and air links, is crucial for making these destinations accessible and attractive. These measures collectively aim to position tourism as a scalable economic activity that supports job creation, regional development, and investment opportunities across hospitality, transport, digital services, and allied sectors, contributing significantly to the Viksit Bharat vision.

Conclusion: A Blueprint of Continuity for Viksit Bharat – The Path Forward

So, is Union Budget 2026 a bold blueprint for Viksit Bharat or a cautious bridge of continuity? After a thorough examination of its various facets, from macroeconomic strategy to granular sectoral allocations, it becomes unequivocally clear that it is, in fact, a “Blueprint of Continuity.” This budget is not characterized by radical, disruptive changes designed to shock the system, but rather by a strategic and sustained effort to build upon existing strengths, consolidate gains, and accelerate progress towards the overarching, ambitious vision of a developed India by 2047.

The narrative woven through Budget 2026 is one of strategic patience and consistent execution. It recognizes that monumental transformations are rarely achieved through sudden shifts but rather through a series of well-calibrated, persistent efforts. The meticulous weaving together of fiscal prudence, robust capital expenditure, and targeted sectoral interventions is designed to create an enabling environment for sustained, inclusive growth. The unwavering emphasis on bolstering domestic manufacturing, developing cutting-edge digital infrastructure, fostering equitable regional development, and investing heavily in human capital development are not isolated initiatives; they are interconnected threads in this grand blueprint, each reinforcing the other to create a resilient and dynamic economy.

This budget prioritizes execution, resilience, and inclusive growth. It is a testament to a governance philosophy that seeks to ensure that the benefits of economic progress are not concentrated in a few pockets but are widely distributed, reaching all sections of society, from the smallest micro-enterprise to the largest industrial conglomerate, and from the urban centers to the remotest villages. The focus on “Yuva Shakti” and MSMEs, coupled with investments in healthcare and education, underscores a commitment to human development as a prerequisite for national development.

For you, the discerning investor, entrepreneur, or citizen, this budget offers a clear and actionable roadmap. It signals precisely where the government’s priorities lie and, consequently, where the most significant future growth opportunities are likely to emerge. Understanding these nuances—the subtle shifts, the reinforced commitments, and the long-term vision—will be absolutely key to positioning yourself to thrive in the evolving Indian economic landscape. Whether you are looking to invest in emerging sectors, expand your business, or simply understand the direction your nation is heading, the budget provides invaluable insights.

In essence, Budget 2026 is a declaration that the journey to Viksit Bharat is a marathon, not a sprint. It provides a steady, well-thought-out pace for this transformative race, ensuring that India builds its future on solid foundations, capable of withstanding global shocks and capitalizing on emerging opportunities. It is a budget that looks beyond the immediate fiscal year, laying down markers for a prosperous and self-reliant India by 2047. The continuity it offers is not stagnation, but a consistent, determined stride towards a brighter future.